Banking account

- Opening a bank account for individuals, except for cases defined by this clause **

AMD 2,000

- Opening a bank account of a physical entity customer with an identity document of foreign countries /not the Republic of Armenia/

AMD 50,000

- Opening a bank account for a legal entity /private entrepreneur/ notary/ except for cases defined in this clause

AMD 10,000

- Bank account opening

AMD 70,000

a/non-resident legal entity

c/ A legal entity registered in the Republic of Armenia, more than 50 percent of whose participants/shareholders are individual(s) with identity documents from other countries (not the Republic of Armenia) or non-resident legal entity (s),

d/ Private entrepreneur registered in Armenia with an identity document of other countries /not RA/

- Opening an additional account for customer

AMD 1,000

- For a legal entity/private entrepreneur/notary

AMD 3,000

* The tariff for opening a bank account for a physical entity in Customer Service Central Office makes AMD 5,000.

** The tariff for opening an additional account for a physical entity in Customer Service Central Office is AMD 3000. The tariff for opening an additional account is charged for opening a new account /accounts/ by a customer having an account every time the client submits an application. If the client has a bank account opened in the Bank, the new account /accounts/opened in any other territorial/ structural subdivision of the Bank is considered as additional.

AMD 20,000

- Bank account opening

AMD 5,000

- Opening each additional account

AMD 1,000

Free of charge

- Free of charge

a/ non-profit organizationsb/state-owned companies c/NGOs

c/ non-governmental organizations

d/ resident individuals being RA pensioner

free of charge

Opening a savings account /AMD/ only via “AEB Mobile/Online” system/

Free of charge

free of charge

In case of not installing a Trade and Service Outlet within 60 calendar days since the date of opening in case of a positive account balance the tariff set for opening an account is charged, and in case of lack or insufficiency of funds the account is subject to closure.

Free of charge

- AMD 500

up to AMD 100,000

- Free of charge

AMD 100,001 and more

0.01%

(min AMD 500)

1.5%

2%

Free of charge

1%

Free of charge

Free of charge

Free of charge

* Except of depositing or exchange of banknotes with a nominal value of USD 5, 10, 20, 50 issued until 2004 and USD 100 banknotes issued before 2009

0%

0.5%

2%

* When calculating the commission for cash withdrawals from customer accounts, the basis is the difference between the total amounts deposited and withdrawn in cash from the client's account in the ARMECONOMBANK OJSC system on the day of cash withdrawal and the 182 days preceding it. The funds credited to funds via ATMs are considered as cashless funds credited to client’s funds. No fee is charged for cash withdrawals of child and terms deposits placed in cash by individuals, as well as transactions with bonds issued by ARMECONOMBANK OJSC and purchased in cash from the Bank (bond sale, bond redemption)

Funds deposited to accounts via terminals are considered non-cash funds credited to the customer’s account.

No fee is charged for the cash withdrawal of funds deposited as a result of cash contributions to child and term deposits by individuals, or transactions related to bonds issued by “ARMECONOMBANK” OJSC and purchased in cash from the Bank (bond sale, bond redemption).

AMD 500

0.5%

(minimum AMD 1000)

1%

(minimum AMD 1000)

0.5%

2%

0%

* The withdrawal commission does not apply to:

- On interest accrued on child and term deposits invested by individuals, interest paid on funds available in bank accounts, interest paid on bonds issued by ARMECONOMBANK OJSC (coupon income), dividends paid by ARMECONOMBANK OJSC, loans provided to individuals with the pledge of gold items and with the pledge of funds, loans provided in AMD with the provision of salary to the Bank's employees, and withdrawals of non-cash funds resulting from transactions carried out through POS terminals installed by ARMECONOMBANK OJSC,

- On withdrawals of AMD funds by charitable organizations,

- On withdrawals of amounts from social package accounts, social security accounts, state support accounts,

- For loan types, whose cash withdrawal rate is specified at the time of issuance, the minimum threshold of AMD 1000 does not apply.

AMD 500

0.3% (minimum AMD 1000)

1% (minimum AMD 1000)

0.5%

2%

0%

The withdrawal commission does not apply to:

- On interest accrued on child and term deposits invested by individuals, interest paid on funds available in bank accounts, interest paid against bonds issued by ARMECONOMBANK OJSC (coupon income), dividends paid by ARMECONOMBANK OJSC, loans provided to individuals with the pledge of gold items and with the pledge of funds, loans provided in AMD with the provision of salary to the Bank's employees, and withdrawals of noncash funds resulting from transactions carried out through POS terminals installed by

ARMECONOMBANK OJSC, - On withdrawals of AMD funds by charitable organizations,

- On withdrawals of amounts from social package accounts, social security accounts, state support accounts,

- For loan types, whose cash withdrawal rate is specified at the time of issuance, the minimum threshold of AMD 1000 does not apply

AMD 500

AMD 1,000

1%

(minimum AMD 3,000)

1%

(minimum AMD 1,000)

* This tariff does not apply to withdrawals of amounts paid in cash and refunded amounts.

Free of charge

5%

not accepted

AMD 5,000

AMD 10,000

AMD 15,000

AMD 20,000

AMD 30,000

* This tariff does not apply to execution of any transaction in foreign currency in the bank. The authenticity of a cash foreign currency provided by the citizen is verified by a cashier of ARMECONOMBANK OJSC, is packed, stamped and returned to the client in accordance with the established procedure

0

2% min. AMD 500

* The defined tariff does not apply to clients having acting accounts in ARMECONOMBANK OJSC and when crediting to acting accounts in ARMECONOMBANK OJSC

- AMD 500

up to AMD 250,000

- AMD 1,000

AMD 250,001- 500,000

- AMD 1,500

500,001- 1,000,000

- AMD 3,000

1,000,001- 3,000,000

- AMD 5,000

3,000,001- 5,000,000

- AMD 7,000

5,000,001 and more

* Cash transfers in AMD to the National Military Insurance Fund's donation account No. 103008660005 and to the stamp duty account No. 900005001186, established in accordance with the Law on Compensation for Damage Caused to the Life or Health of Servicemen During the Defense of the Republic of Armenia, are made free of charge.

a) Up to AMD 100,000- AMD 500

b) AMD 100,001 and more – free of charge

* Except for cash receipts to social package accounts, tariff payments, receivables, cash payments for loans not exceeding AMD 1,000, repayment of written-off loan liabilities, and intra-bank cash receipts for the purpose of final repayment of loan liabilities.

AMD 300

* This tariff does not apply to the execution of transfers with payment orders from the bank account of a physical entity customer , for social package, for attracting deposits, charging tariffs, repaying their existing credit obligations in ARMECONOMBANK OJSC system, and payment orders for the purchase of ARMECONOMBANK OJSC bonds and shares.

AMD 300

* When making non-cash transfers in AMD from the bank account of a legal entity / private entrepreneur / notary customer without submitting a payment order by the client, an additional fee of AMD 100 is charged for each transfer. The abovementioned and the additional AMD 100 fees do not apply to transfers made for the purpose of attracting term deposits, charging tariffs, repayment of their existing credit obligations within the system of ARMECONOMBANK OJSC, as well as for acquiring bonds and shares of ARMECONOMBANK OJSC. For execution of a payment order by the attached distribution list, a fee of AMD 300 is charged.

AMD 500

0.6% (minimum AMD 500)

AMD 500

- AMD 5,000

up to USD 20,000 or EUR 20,000

- AMD 10,000

USD or EUR 20,001 and more

- free of charge

Transfer of amounts gained from the repayment interests for USD bonds issued by CENTRAL DEPOSITORY OF ARMENIA OJSC and ARMECONOMBANK OJSC for the

- AMD 2,000

AMD, USD, EUR

- free of charge

Change and/or cancellation in the terms of interbank transfers (in ARMECONOMBANK OJSC system)

* If the transfer has not yet been sent from the Bank, the fee for changing/cancelling the transfer terms is not charged. Changing and/or canceling the terms is carried out within 3-5 business days (except for payments made to the state and local budgets). Transfers made cannot be canceled if the beneficiary (recipient) of the amount refuses to return the transferred amount.

free of charge

AMD 5,000

* Annual maintenance fee is not charged if the account balance is zero

1 g

0%

0.1% / min AMD 15,000/ of the amount calculated at the exchange rate set by RA CB at the moment of executing a transaction on the

quantity of metal to be transferred

AMD 0

AMD 5,000

Free of charge

0.15% of transaction amount

/minimum AMD

25,000, maximum AMD 200,000 /

AMD 15,000

- AMD 15,000 per month

No transaction has been made from 365 to 730 days

- AMD 20,000 per month

No transaction has been made from 731 to 1095 days

- AMD 25,000 per month

No transaction has been executed for 1096 days and more

* The established tariff does not apply to accounts of account holders in liquidation process, bank accounts under arrest, social package, state support accounts, social security bank and card accounts, as well as to term deposits invested in the Bank, upon the expiration of which the deposits became demand deposits. This tariff applies to card accounts whose card has expired, the card has not been reissued and no transactions have been made on the account for 365 or more days preceding the card expiration date.

- Provision of statements

AMD 0

- Provision of copies of payment documents regarding transactions made during the previous and given months

AMD 0

- Provision of copies of payment documents regarding transactions executed in other period

AMD 1,000

- Provision of statement

AMD 5,000

- Provision of a statement regarding amounts credited on the same day

AMD 8,000

- Provision of copies and/or duplicates of SWIFT messages

AMD 1,000

- The statute of limitations is up to 1 month

- Provision of payment documents, account statements * **

AMD 0

- Provision of copies and/ or duplicates of SWIFT messages, other information and references *

AMD 1,000

b/ * The statute of limitations is from 1 to 3 months - AMD 1,500

c/ * the statute of limitations is from 3 to 1 year - AMD 2,500

d/ * the statute of limitations is more than 1 year - AMD 5,000

e/ * Provision of copies and/or duplicates of SWIFT messages - - AMD 1,000

Statements and payment documents on the transactions implemented within the previous month can be provided free of charge up to the last banking day of the coming month inclusive

AMD 5,000

AMD 5,000 per month

*No fee is charged for a one-time execution application order if the order may be executed within 10 calendar days. A fee is charged for current fulfillment of application order, if an order has been executed in the given month, Application orders provided with the aim of serving TSOs, social package accounts, state support accounts and with the aim of replenishment of Child deposit and “Accumulative voluntary deposit”, utility payments are made free of charge.

AMD 5,000

* Cash check books are provided free of charge for servicing Treasury custodians.

In case of cash withdrawal by a legal entity/individual entrepreneur customer using a cash withdrawal order, a fee of AMD 500 is charged.

AMD 15,000

- Transaction executed in AMD, RUB currencies

AMD 3,000

- Transactions made in other currencies

AMD 30,000

* ARMECONOMBANK OJSC does not bear responsibility for not receiving a reply from a correspondent bank.

AMD 3,000

Except for social security accounts, powers of attorney issued for repayment of loan by private entrepreneurs

AMD 3,000

* Excluding social security accounts, power of attorney issued by individual entrepreneurs for the purpose of loan repayment

- a/ legal entity /PE/ customer

AMD 10 / each SMS /

- b/ Physical entity customer

AMD 20 / each SMS /

* A statement is provided free of charge in the cases /to customers/ as follows:

- Individuals who have term deposits/bonds of AMD 3,000,000 (or equivalent foreign currency) or more deposited with the Bank for at least 20 calendar days at the time of providing the reference.

- corporate entities or physical entity customers being directors of these entities whose total average balance of bank, card and/ or term deposit accounts of the previous month exceeds AMD 10,000,000 (or equivalent currency),

- to physical entities having the “Maximum” package of savings account,

- bank employees,

- Issuance of statements for serving social package and state support accounts.

At the transaction date, the provision of payment document or its copy (including the copies of SWIFT messages and/or their copies) , as well asdocument copies of up to 1 year transactions implemented via “Mobile/Online banking” system are provided free of charge, For the provision of copies of documents on more than one year transactions executed via “Home bank”, “Mobile/Online banking” system a tariff in the amount of AMD 1000 is charged.

Annual interest rate is calculated for cash funds existing on the accounts, based on account type and/or balance in the following sizes:

| Annual interest rate | Annual percent yield | |

| 1. For the funds available in the bank account in AMD and foreign currency | 0% | 0.00% |

| 2. Against funds existing on special social package account | 0.1% | 0.1% |

| 3. Against the funds available on state support account | 5% | 5.12% |

| 4. Against funds available on escrow account | 0% | 0.00% |

| 5. Against funds existing on unallocated metal account | 0% | 0.00% |

Interests are calculated on daily basis against funds existing on account during the accounting month and are paid on

the first working day of the month following the accounting month.

Moreover;

- if the account has been opened and/or account funds have been accrued during the accounting month, the average

daily calculation of interests is implemented by the calculation of the calendar days of the accounting month, - if account is closed during the accounting month, then the interests are not paid for that month.

Interests are calculated on daily basis against funds existing on account during the accounting month and are paid on the first working day of the month following the accounting month.

Moreover;

- if the account has been opened and/or account funds have been accrued during the accounting month, the average daily calculation of interests is implemented by the calculation of the calendar days of the accounting month,

- if account is closed during the accounting month, then the interests are not paid for that month.

In the calculation, a year is assumed to have 365 days, and 366 days for a leap year.

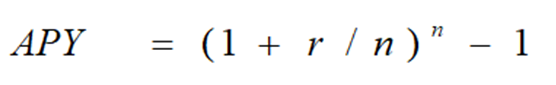

The annual percent yield is calculated in compliance with the procedure set by CBA by the following formula:

where

1) APY – is the annual percent yield,

2) r – is the annual simple interest rate,

3) n –periodicity of interests capitalization within a year

Below is an example of calculating interest (in the calculations the year was assumed to have 365 days, and interest amounts were calculated taking into account income tax):

|

E.g |

Average daily balance of the month |

Amount of annual nominal interest rate |

Interest receivable (in 31 days) |

|

1 |

AMD 500,000.00 |

5% |

AMD 1910.90 |

NOTE: INTEREST ON THE FUNDS AVAILABLE ON YOUR ACCOUNT WILL BE CALCULATED BASED ON THE NOMINAL INTEREST RATE AND THE ANNUAL PERCENT YIELD SHOWS THE INCOME YOU WOULD HAVE RECEIVED IF YOU WOULD HAVE MADE THE MANDATORY PAYMENTS REGARDING THE DEPOSIT AND WOULD HAVE RECEIVED THE ACCRUED INTERESTS AT THE SET PERIODICITY . YOU WILL FIND THE ORDER OF CALCULATING THE ANNUAL PERCENT YIELD ON THE FOLLOWING WEBSITE: www.aeb.am

The Bank has the right to unilaterally change the payable interest.

For account opening, an individual customer shall submit the following:

-

Identity document

-

Document containing the Public Services Number (PSN)

-

Certificate of registration from the State Register of Individual Entrepreneurs or an extract from the Unified State Register and seal (at the customer’s discretion) (required only for individual entrepreneurs)

-

Tax code (required only for individual entrepreneurs if not mentioned in the certificate or extract, and for notaries)

-

Notary’s service certificate (required for notaries)

A resident legal entity shall submit the following for bank account opening:

-

Identity document of the director (executive)

-

Certificate of registration from the State Register of Legal Entities (also including the registration insert of the current director) or extract from the Unified State Register and reference on participants (issued within the last 30 days)

- If information on participants is not included in the Charter or the extract

- For joint-stock companies – an extract provided by the Central Depository

- If 20%+ participants are legal entities – the same information shall be provided for each in the ownership chain

- One copy of the Charter – stitched and sealed with the note “True to the original”

-

Tax code (if not mentioned in the certificate or extract)

-

Orders or other documents confirming the appointment of persons authorized to sign

For account opening by power of attorney (for all types of legal entities):

-

Original notarized power of attorney

-

Identity document of the authorized person

-

Copy of the director’s identity document

For a dissolving/insolvent legal entity:

-

Decision(s) from the competent authority on liquidation or insolvency

-

Decision on appointment of the insolvency administrator

For opening a special account by a developer:

-

Copy of the building construction permit

A non-resident legal entity shall submit the following for account opening:

- identification document of the director (manager),

- a notarized Armenian translation of the original reference (information) on the participants, if the information on the participants is not included in the charter), moreover:

in the case of a legal entity with a 20% or more participation in the participants, a notarized Armenian translation of the original reference (information) on the participants with a 20% or more participation in the given legal entity is also required, and so, in the case of a legal entity with a 20% or more participation in the participants, a reference (information) on the participants with a 20% or more participation in the said legal entities is required. - Should the authorized entity (entities) open an account- notarially certified Armenian translation of the original power of attorney

- Notarially certified Armenian translation of the original document confirming the registration of the legal entity by the Authority carrying out the state registration of legal entities in the country of origin of the non-resident legal entity

- Notarially certified Armenian translation of the original document on the registration and jurisdiction of the non-resident legal entity’s manager given by the Authority carrying out the registration of legal entities in the country of origin of the non-resident legal entity, notarially verified copy of the identification document of the legal entity’s manager,

- Notarially certified Armenian translation of non-resident legal entity’s founding documents (charter, founding agreement and etc.)

- The Bank may open temporary, primary, allocated metal, escrow, and special developer accounts, as well as other special accounts stipulated by the RA legislation and normative legal acts of the Central Bank of Armenia.

- A temporary account is opened for newly established legal entities and individual entrepreneurs in the registration phase.

- Primary accounts are opened for individuals and registered legal entities (including individual entrepreneurs and notaries).

- A special developer account is opened for individuals and registered legal entities (including individual entrepreneurs).

- Developer accounts are opened only in AMD, whereas temporary and primary accounts can be opened in AMD or foreign currency.

- The following transactions may be performed via the account:

- Cash/non-cash deposits to the account,

- Cash withdrawals within the available balance,

- Non-cash transfers within the available balance,

- Transfers between the customer's accounts,

- Other transactions defined by the respective account summary statements. - Remote account management is available via the Bank’s electronic systems:

- AEB Mobile – an electronic platform enabling service through a mobile application without visiting the Bank,

- AEB Online – an online platform enabling service through the internet without visiting the Bank.

Terms and tariffs for AEB Online and AEB Mobile services are available via the following link: https://www.aeb.am/en/mobile_banking/ - Transactions in currencies other than the account currency cannot be executed through the same account.

- Funds (non-cash gold) transferred to the customer's account shall be credited no later than the next business day following the receipt of the respective payment documents by the Bank.

- Funds shall be debited/transferred (non-cash gold – transferred) from the account no later than the next business day upon receipt of the payment documents, or, if transactions are executed by the customer's authorized representatives, within two banking days after submission of a valid power of attorney that complies with RA legislation and the Bank’s internal regulations, provided that the Bank has identified the customer and the authorized person.

- The rights of the account holder to dispose of the account and the funds therein may be restricted by a court decision or based on resolutions of enforcement or tax authorities.

- In cases defined by the RA legislation, and in accordance with established procedures, funds on the account may be seized without the account holder’s instruction, based on judicial acts or decisions by enforcement or tax authorities. The Bank shall inform the customer thereof within 30 calendar days, providing an account statement via the customer’s communication method.

- The Bank may unilaterally perform a non-acceptance set-off to recover monetary obligations owed by the customer to the Bank. In such cases, the Bank shall notify the customer within 30 calendar days, providing an account statement via the customer’s communication method.

- An account may be closed either, upon the customer's unilateral request, or unilaterally by the Bank in case of a zero balance and no transactions for one year, non-payment of service fees or other obligations, or in other cases stipulated by account terms.

In case of account closure, the remaining balance shall be returned to the customer or transferred to another account as instructed, within seven calendar days upon receipt of a written request, after which the account will be closed. - Customers may submit questions, proposals, complaints or claims in writing to the Bank, to which a response will be provided within 10 business days. If the customer disagrees with the response, they may appeal to the court or to the Financial System Mediator, in accordance with the law.

- No minimum initial deposit is required for opening bank accounts.

- Interest paid by the Bank to individuals is subject to income tax in accordance with the RA Law on Income Tax.

- An escrow account is opened only in AMD.

- Funds deposited to the escrow account (escrow funds) are contributed by the depositor as a guarantee for the execution of a transaction, to be released to the beneficiary of the escrow in accordance with the escrow agreement.

- Escrow funds may be released (in cash or by transfer) by the Bank (Escrow Agent) to the beneficiary based on submission of the document defined by the escrow agreement, or written instruction from the depositor authorizing the Bank to release the escrow funds.

- If the required documents are not submitted within the timeframes set by the escrow agreement, the escrow account will be reclassified into a primary bank account of the depositor, granting them the right to manage the funds.

- Once the escrow funds are fully withdrawn / account balance reaches zero, the escrow account shall be closed

- Escrow accounts may be opened for both individuals (including sole proprietors) and legal entities.

- An allocated metal account is a demand account intended for non-cash gold accounting, opened only with 999.9 purity. The following transactions may be executed:

- Account replenishment via non-cash purchase of gold from the Bank, or via non-cash gold transfer from another metal account (held at the Bank or another bank) of the customer or a third party,

- Account withdrawal via sale of non-cash gold to the Bank, or non-cash gold transfer to another metal account (held at the Bank or another bank). - Transactions are executed based on the Bank’s rates for 1 gram of non-cash gold (buy/sell).

- Allocated metal accounts do not imply physical delivery of gold.

- Allocated metal accounts are not insured by the Deposit Guarantee Fund.

- In line with RA legislation and the Bank’s internal acts, the Bank may require additional documents, agreements, or information from the customer.

- In cases and periodicities defined by RA legislation, the Bank shall provide account statements in the language preferred by the account holder.

- In accordance with the RA Law on Combating Money Laundering and Terrorism Financing, for proper customer due diligence, the Bank may request additional documents or information, and may ask additional questions during verbal communication, following the Know Your Customer (KYC) principle.

- Under the Foreign Account Tax Compliance Act (FATCA) and the related agreement with the United States, the Bank may collect additional information from the customer to verify U.S. taxpayer status.

- The procedure, format, requirements, principles, rights and obligations of customers, liability, and general conditions for banking services provided by the Bank are defined by the “General Terms of Rendering Banking Services” approved by the Bank’s Executive Board, available at: https://www.aeb.am/en/sakagner/

- The Bank may define alternative tariffs (higher or lower) or provide services free of charge for a particular customer, differing from those stated in this informational summary.