Savings account

Free of charge

exclusively via AEB Mobile/AEB Online systems

- Issued in AMD

A VISA GURU or VISA GURU TRAVEL card type (If the customer does not own any of such cards, in case of issuing a VISA GURU DIGITAL card the annual service fee of the card is set free of charge)

other physical card, except for ArCa Social, ArCa gift cards (If the customer does not have a physical card, in case of issuing a MASTERCARD STANDARD or VISA CLASSIC card the card’s annual service fee is defined AMD 1,000 (one thousand)

In accordance with the tariffs defined for a bank account by information bulletin for “Account opening, servicing and other services (see in https://aeb.am/hy/conditions-and-tariffs link)

| Avaerage daily balance of the funds available in the Account during the reporting month | Type of package | Annual nominal interest rate | Annual interest yield |

| AMD 200,000 – 2,000,000 | Start | 4.00% | 4.07% |

| AMD 2,000 001 – 5,000,000 | Comfort | 4.50% | 4.59% |

| AMD 5,000 001 – 10,000,000 | Maximum | 5.00% | 5.12% |

Based on the package priveleges for using the other services of the Bank may apply, which are defined by information bulletins of appropriate services.

- Cash/cashless deposits of funds to the account

- Cash disbursements of funds within the positive account balance

- Cash transfers to other account of the customer acting in the Bank within the limits of positive account balance

- Cashless conversion of funds between different accounts of the customer

The account balance may be supplemented and reduced without any monetary or quantitative limitations

No minimum amount is defined for carrying out account operations

It is not possible to perform transactions in currencies other than the account currency

The accounts may be managed remotely via AEB Mobile/AEB Online systems

The account may also be credited with funds received from third parties

Interests are calculated on daily basis against funds existing on Account during the accounting month and are paid on the first working day of the month following the accounting month being added to the Account balance.

In the calculation, a year is assumed to have 365 days, and 366 days for a leap year. If the Account has been opened and/or Account funds have been accrued during the accounting month, the average daily calculation of interests is implemented by the calculation of the calendar days of the accounting month If the Account is closed during the accounting month, no interests are paid for that month.

If the average daily balance of the funds available in the Account exceeds AMD 10,000,000 (ten million) during the reporting month, interests are accrued and paid for AMD 10,000,000 (ten million) for that month (no interests are calculated and paid against the portion exceeding that amount), and the package type is Maximum.

Calculation examples

In the calculation, a year is assumed to have 365 days.

In the samples below, the calculation has been made for a month having 31 calendar days.

Sample 1

- Average daily balance of the month - AMD 1,000,000.00,

- Annual nominal interest rate - 4%

- Interest payable prior to income tax withholding - 1,000,000.00 * 4/100/365 * 31 = AMD 3,397.30

- Interest payable following income tax withholding (10%) – 3,397.30 - 3,397.30*10/100 = AMD 3,057.60

Sample 2

- Average daily balance of the month - AMD 3,500,000.00,

- Annual nominal interest rate– 4.5%

- Interest payable prior to income tax withholding - 3,500,000.00 * 4.5/100/365 * 31 = AMD 13,376.70

- Interest payable following income tax withholding (10%) – 13,376.70 - 13,376.70*10/100 = AMD 12,039.00

Sample 3

- Average daily balance of the month - AMD 7,500,000.00,

- Annual nominal interest rate – 5%

- Interest payable prior to income tax withholding - 7,500,000.00 * 5/100/365 * 31 = AMD 31,849.30

- Interest payable following income tax withholding (10%) – 31,849.30 - 31,849.30*10/100 = AMD 28,664.40

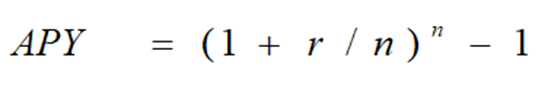

* The annual percentage yield on the deposits is calculated in compliance with the procedure set by CBA by the following formula:

where

1) APY – is the annual percentage yield of the deposit

2) r – is the annual rate of simple interest

3) n – periodicity of interests’ capitalization in a year

NOTE: INTEREST ON THE FUNDS AVAILABLE ON YOUR ACCOUNT WILL BE CALCULATED BASED ON THE NOMINAL INTEREST RATE AND THE ANNUAL PERCENT YIELD SHOWS THE INCOME YOU WOULD HAVE RECEIVED IF YOU WOULD HAVE MADE THE MANDATORY PAYMENTS REGARDING THE DEPOSIT AND WOULD HAVE RECEIVED THE ACCRUED INTERESTS AT THE SET PERIODICITY . YOU WILL FIND THE ORDER OF CALCULATING THE ANNUAL PERCENT YIELD ON THE FOLLOWING LINK: https://www.arlis.am/hy/acts/53049

- The Bank credits the funds credited to the Customer’s Account no later than the next banking day following the receipt of the relevant payment document by the Bank.

- The Bank executes the Customer’s instruction to debit funds from the Account no later than the next banking day following the receipt of the relevant payment document by the Bank, unless other timeframes are stipulated by law, or by the banking rules and conditions established in accordance with it.

- The accountholder’s right to manage the account and monetary funds available on it can be restricted by Court decision based on the application submitted by Judicial Acts Compulsory Enforcement Bodies or tax authorities.

- Without accountholder’s instruction, upon court decision, upon the application submitted by Judicial Acts Compulsory Enforcement authorities or tax authorities and tax authorities, the funds in the Account may be seized, after which the Bank is obliged to inform the Customer thereof within 30 calendar days, providing an account statement through the latter's communication method.

- On the purpose of fulfillment of Customer’s monetary obligations towards the Bank, the Bank, without prior notice, can write off monetary funds. Afterwards the Bank is obliged to inform the Customer thereof within 30 calendar days providing the Customer with Account statement through the latter’s means of communication.

- The Customer may submit his/her questions, suggestions, complaints, and claims to the Bank by applying in writing to the Bank, to which the Bank shall respond within 10 business days.

- The customer may submit its complaints and claims to the Financial System Mediator of RA in accordance with the procedure, cases and terms defined by RA law “On Financial System Mediator”.

- If disputes arising between the Customer and the Bank are not resolved through negotiations, they may be settled through Arbitration or by a competent authority of the Republic of Armenia (RA courts, RA notaries — in accordance with the procedure and cases defined by RA legislation).

- The account may be closed at any time upon the client's unilateral application or unilaterally by the Bank in cases of absence of funds in the Account and no transactions made within the Account within one year, failure to pay the established fees or fulfill other obligations by the client, as well as in other cases defined by the “General Terms of Provision of Banking Services” (see: https://www.aeb.am/uploads/bankayin_carayutyunneri_paymanner.pdf).

- In the event of account closure, the remaining balance in the account is provided to the customer in cash or, upon the customer’s instruction, is transferred to another account held by the customer in the Bank, no later than within seven days from the date of receiving the respective request from the client, after which the Account is closed.

- In cases and periodicity not exceeding a month established by RA Law, the Bank provides the accountholder with Account statements in the language the latter prefers, except for the case if the Account has not been debited or credited in the reporting period.

- Interests payable on the funds available in the account is subject to taxation in accordance with the rate and procedure defined by the RA Law “On Income Tax”.

- The bank is entitled to unilaterally change the interest rate accrued against the savings account , notifying the customers at least 15 days prior to the entering of the change into force.

- The procedure, form of provision of banking services, general terms, sizes and deadline for payment of Bank’s fees are defined by the general agreement for prividing Banking services and "General Terms for Providing Banking Services", as well as by the information bulletins of relevant banking services.

- The deposits are guaranteed according to RA Law “On Guaranteeing the Compensation of Bank Deposits of Natural Persons”.

- In case of bank deposits in AMD, the deposit is guaranteed for AMD 16m,

- In case of bank deposits denominated in foreign currency only, the deposit is guaranteed for AMD 7.0m,

- In case of bank deposits in AMD and foreign currency if the AMD bank deposit exceeds AMD 7.0m, only the AMD bank deposit is guaranteed up to AMD 16m,

- In case of bank deposits both in AMD and in foreign currency: if AMD bank deposit is smaller than AMD 7.0m, the AMD deposit is guaranteed in full and the bank deposit in foreign currency is guaranteed for the balance of AMD 7.0m and recovered AMD bank deposit.

ON THE PURPOSE OF DUE DILIGENCE OF THE CUSTOMER ENVISAGED BY RA LAW ON “ON COMBATING MONEY LAUNDERING AND TERRORISM FINANCING” , THE BANK MAY REQUEST ADDITIONAL DOCUMENTS OR OTHER INFORMATION FROM THE CUSTOMER BASED ON “KNOW YOUR CUSTOMER” PRINCIPLE, AS WELL AS ASK THE CUSTOMER ADDITIONAL QUESTIONS DURING ORAL COMMUNICATION.

UNDER THE FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA)), IN ACCORDANCE WITH THE AGREEMENT SIGNED WITH THE USA, THE BANK MAY COLLECT ADDITIONAL INFORMATION FROM THE CUSTOMER TO DETERMINE WHETHER IT IS A US TAXPAYER.

DUE TO VARIOUS CIRCUMNSTANCES ADDITIONAL DOCUMENTS AND INFORMATION MAY BE REQUESTED FROM THE CUSTOMERS.

“YOU ARE ELIGIBLE TO COMMUNICATE WITH FINANCIAL INSTITUTION BY THE MEANS OF COMMUNICATION YOU PREFER – THROUGH POSTAL SERVICES OR ELECTRONICALLY. THE RECEIPT OF INFORMATION ELECTRONICALLY IS THE MOST CONVENIENT. IT IS AVAILABLE ROUND-THE-CLOCK (24/7), IS FREE OF THE RISK OF LOSS OF PAPER INFORMATION AND ENSURES CONFIDENTIALITY”.

“ATTENTION. “YOUR FINANCIAL INFORMANT” (www,fininfo.am) IS AN ELECTRONIC SYSTEM WHICH SEARCHES, COMPARES THE SERVICES OFFERED TO INDIVIDUALS AND FACILITATES THE SELECTION OF THE MOST EFFECTIVE OPTION FOR YOU”.